IDTechEx has substantially updated and added to its entire wearable technology market research portfolio.

The wearable technology reports are now including a dedicated supporting document discussing the impact of COVID-19 on the industry. The following points illustrate some of the most significant conclusions, figures, and data from the latest IDTechEx research report offerings.

1. 2019 saw the largest single year growth rate for wearable technology product revenue since 2015

The wearables market had a very strong 2020, growing 19% to reach a total of $70bn for the year. The most significant product sector driving an increase in growth over the previous year was the true wireless headphones product sector, as part of hearables, which generated over $4bn of new revenue relative to 2018.

The other strongest growth came from device categories such as smartwatches and continuous glucose monitoring (CGM) devices, which grew by just under $4bn and $1.3bn respectively relative to 2018 values. This represents the largest one year growth rate since peak wearables hype in 2015 (a year which saw the commercial launches of leading devices such as the Apple Watch), which emphasises the growing strength in the sector and the continuing opportunity for new development and growth.

2. COVID-19 has already had a significant impact on 2020 revenues, but many sectors retain long-term optimism

The COVID-19 pandemic continues to have a profound societal and economic impact, and many wearable products have been part of this. The most critical impact to date has been at the point-of-sale for many products, with lockdowns and social distancing measures meaning that stores are closed, doctors appointments are not taking place in person and sales of many products have been significantly impacted as a result. However, the impact has been very varied; where some products have seen as much as an 80% reduction in sales for Q2 2020 vs Q2 2019, other areas such as remote patient monitoring devices have been accelerated onto the market to assist in pandemic countermeasures.

As such, there is a complex picture, which is covered at length in the IDTechEx report portfolio via a primer document on COVID-19, which is available with all IDTechEx wearable technology reports.

3. Specific regulatory changes coming in 2020 and 2021 will have a significant impact in skin patches, hearables and beyond

The impact of the COVID-19 pandemic is profound and as such has by far the largest impact on the short-term outlook for the sector. However, the reports highlight regulatory changes as another factor which will have a significant impact going forward. This has already been seen in relation to COVID-19, where many products involved in pandemic countermeasures have been fast-tracked to FDA approvals. Regulatory barriers are critical challenges for many players, from new start-ups to global leaders, and changes to them can shift the dynamic immediately.

The IDTechEx reports highlight several other specific regulatory changes which have been longer awaited, which will cause disruption in the product areas covered. In hearables, the Over the Counter Hearing Aid act requires guidelines for that product category to be established by August 2020, paving the way for a new generation of hearing assistance products which can be approved and reimbursed as part of the US healthcare system.

In electronic skin patches, new regulatory and reimbursement frameworks for wearable cardiovascular monitoring focusing on mobile cardiac telemetry and extended Holter monitoring are expected to be confirmed in 2020 and implemented in early 2021. Both of these steps introduce new product opportunities, and the research details ways in which companies are planning to adapt to these changes as they are implemented. We expect these changes in regulation to have an immediate impact on the industry dynamic in the markets which they affect.

4. Technology giants target the move from consumer to medical, with wearables as a key ingredient

Technology players, such as Apple, Google, Samsung, Microsoft and many others, have long been investing in product and platform development with relevance to health and wellness. Whilst this in itself is not new information, the report highlights the increasing prevalence of medical sensing metrics being deployed into traditionally consumer wearable products. Smartwatches have been demonstrated with ECG for atrial fibrillation, PPG for oxygen saturation and blood pressure monitoring. In hearables, optical blood pressure is now commonly discussed, joining other more familiar features such as fall detection, core body temperature monitoring and other relevant medical metrics. These and more examples are all included within the IDTechEx reports.

However, the critical point here is that these metrics are not just exclusive to medical devices. In many cases, products are having versions of these features added as part of a standard consumer offerings, complete with appropriate disclaimers that encourage users to consult their doctor if they have challenges. However, when this development is paired with intensive lobbying, as well as significant parallel development of the data infrastructure and supporting systems required for medical devices, it is clear that the longer-term strategy will move in this direction. The wearable devices at the core of this are an essential part of the long-term strategy, and the technology within them is being developed at a remarkable rate.

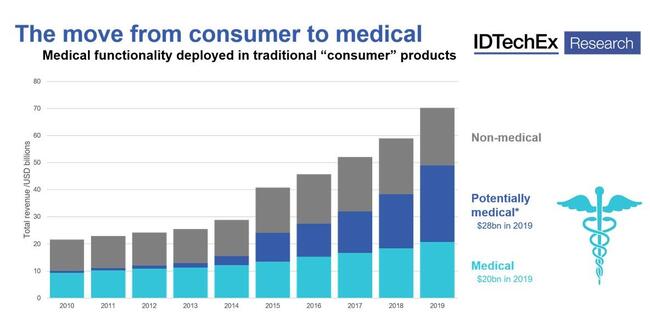

The chart below illustrates this trend within wearable product data. "Potentially medical" products are product categories where sensing capabilities more traditionally associated with medical devices have been introduced in consumer products, which could potentially see some reclassification within the boundaries of medical products further into the future. This is not likely to happen quickly, but this is a significant trend which should not be ignored, regardless of which side of the debate you fall on.

5. From single parameter to multi-parameter sensing

The role of a medical device for sensing is typically to represent one physiological parameter as accurately and reliably as possible. A doctor would then use an appropriate combination of medical device readings and other tests to make an assessment and determine the best course of action. However, as digital health and artificial intelligence are increasingly introduced, the capabilities of medical devices are being expanded such that they can diagnose and monitor specific conditions with increasing independence from the doctor.

This trend goes hand in hand with increasing adoption of multi-parametric sensing on medical devices. Whilst these are not necessarily new, it is still the case that the majority of medical device categories (and particularly those studied within wearables) focus on a single parameter, such as blood glucose, cardiac biopotential, skin temperature, blood pressure and so on. Multi-parameter sensing often presents a much more significant challenge, particularly in navigating regulatory barriers, with companies forced to weigh up the advantages of the new capabilities offered with the significant investment to go through de novo regulatory approval processes which take significantly more time and money.

However, as more pioneers begin to introduce advanced features enabled digital health and AI, these multi-parametric systems will increasingly become the norm. This will have a significant impact on the status quo for many of the product sectors as they exist today, but the change is expected to be a gradual evolution over years and decades. This also goes hand in hand with the previous point; many of the fitness and wellness devices are already using combinations of many different biometric readings to build a more complete picture of the wearer's health. It will just take significantly more time and money for these advances to have their efficacy and safety proven within the context of medical devices too.

Add a Comment

No messages on this article yet