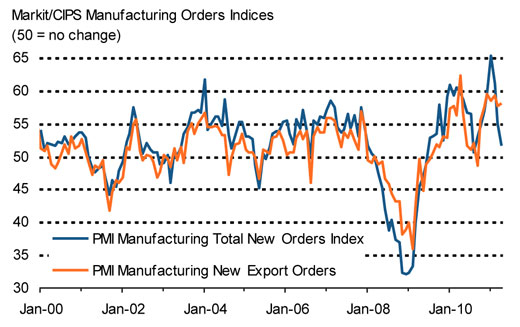

According to Markit/CIPS UK Manufacturing PMI UK manufacturing PMI eased to seven-month low of 54.6; growth of total new orders slowed sharply while exports increased at faster pace; and output price inflation remained close to March's series-record peak.

Rob Dobson, Senior Economist at Markit and author of the Markit/CIPS Manufacturing PMI, commented: "The manufacturing growth spurt looks to be fading rapidly. Although output growth was still expanding at an above long-term average clip, and solid job creation continued, the sector cooled further in April from the near record pace of expansion seen at the turn of the year. The outlook has deteriorated sharply, with new orders growth having collapsed from a booming pace at the start of the year to only register a weak influx of new business in April.

He added: "Manufacturers reported that the domestic market has weakened considerably in recent months, with consumer demand in particular shifting into reverse gear. The sector appears to now be completely reliant on export orders to sustain growth. On the prices front, there was welcome news from a further easing in the rate of increase in input costs from January's record peak. This adds weight to the Bank of England's view that inflationary pressures are transitory and suggests that policymakers will continue to hold fire on the interest rate trigger."

David Noble, Chief Executive Officer at the Chartered Institute of Purchasing & Supply, said: "The outlook for UK manufacturing is definitely bleaker than it was at the start of the year. The sector was racing ahead just a few months ago but there are now clear signs that it is running out of steam. Whilst the sector is still growing at a relatively healthy rate it is now so reliant on exports for growth that we have to be concerned about how sustainable this is.

"The marked slowdown in new orders in April will definitely send a shiver down the spine of many. Much of the output growth came from manufacturers clearing the backlog of existing orders which is the equivalent of a consumer dipping into their savings to maintain their existing spending levels. The problem with this is that, just like savings, backlogs of orders will soon run out if they are not topped up. The falling level of backlogs for the third consecutive month at the same time as new orders slowing really is a worrying sign.

"What we are clearly seeing is a tale of two markets at the moment. Export orders continue to grow at a very healthy rate but domestic demand is suffering as a result of falling consumer confidence and spending. There are some UK manufacturers that are growing very strongly but it tends to be those with a strong export focus and that can truly compete on a global scale. It's clear that manufacturing businesses cannot rely on domestic demand to drive business in the next few months.

"Input price inflation eased again in April which will have relieved some of the pressure on purchasing managers. However, there was a sharp lengthening in supplier delivery times as a consequence of the knock-on effect from the Japanese earthquake and tsunami."

Add a Comment

No messages on this article yet