By Rahul Dhingra, Senior Consultant at Global Intelligence Alliance.

The CEO of a global automotive manufacturer was giving a press conference at the Geneva Car Show in March 2011, when reporters asked him for comments regarding the news that their competitor had just purchased a stake in a key supplier. The CEO replied that he did not know about it; that his company had not been warned in advance. This was embarrassing and left doubts for stakeholders of the company wondering what else did this management not know about?

We can imagine the panicked conversations back at headquarters with middle and senior management alike asking: "What are the implications?", "Are we prepared?", "Who is our secondary supplier?", and later, "Could this have been avoided?"

The implications are that the competitor may now control or at least influence the flow of goods and services to the company in this example. The competitor can limit supplies or cut them off entirely and prioritize its owns interests in the event of shortages. Through the purchase, a competitor now had access to important information, like how much it was purchasing, how often, in what cycle pattern, and for what fees. It may also have access to its designs (or as much of them as are related to this supplier's work).

All of this should have been avoided through ongoing market intelligence.

The need for market intelligence in supply chain management

Market Intelligence for Supply Chain Management has, until recently, been considered a philosophical, nice-to-have, added cost to the corporate procurement department's existing cost-centre. It is almost always associated with being an additional help in the strategic sourcing function. But with a recent upsurge in market activities that are impacting firms' abilities to function, manage and compete, intelligence has a new role in supply chain management.

Joining forces with strategic analysis, market intelligence is forecasting risks and enabling firms to prepare for the worst scenarios imaginable.

Those responsible for intelligence within the corporation will likely agree that intelligence research is sought-after by the marketing department, well-received by the strategy department, required by the executives, and celebrated in any revenue-generating capacity. And that's often where it stops. Try talking about continuous market monitoring or consulting projects geared toward operations, logistics, or supply chain, and it almost always comes down to a budget issue: We can't afford to invest in that right now.

There are a few questions the intelligence director can ask his or her supply chain management colleagues which can turn that budget issue upside-down: We can't afford NOT to invest in that right now.

The following are three areas you might want to consider to avoid any embarrassing questions about your supply chain.

1. What would we do if our competitor acquired our supplier?

Multiple recent cases come to mind: the automotive example exemplifies the impact of this event on a company's brand. Another example of competitors buying suppliers is from the business services industry. Through ongoing market monitoring, a business services company discovered that one of its competitors had acquired a key supplier but lacked a back up plan. Strategic market intelligence for supply chain management is not complete without scenario planning, strategic analysis, and action plans. As such, the company is learning to plan for scenarios like this one, so that monitoring the right companies will lead to timely intelligence which the company is prepared to act on.

A third example involves an educational software company that was well prepared for changes in its supply chain as it had conducted strategic intelligence research on its industry and its competitors through a value chain investigation. The results of the project pointed to a supplier that was identified as an acquisition opportunity. When the software company decided not to pursue this opportunity and the supplier was eventually acquired a few months later, the company was prepared. Having considered the scenario and looking at alternative sources of supply, it had established the necessary relationships in time to avoid the risks associated with the competition owning a source of supply.

Possible solutions

Being prepared means avoiding scenarios like the ones mentioned above. Having secondary sources of supply established and ready is as important as seeing the situation coming. Continuous monitoring of competitors, suppliers, commodities and industries, can enable an early warning system that would at least inform managers of the possibility of an acquisition and prevent any unpleasant surprises.

The Alternative Supply Network

Consider the alternative supply network. Going beyond the traditional supply chain, this view of the industry describes all the companies (competitors, suppliers, customers) that ought to be monitored, and the relationships inherent in the network. Start with understanding "who is working with whom?" and potentially go as far as depicting "what would happen if one of those companies were to disappear?"

Supposing the intelligence analysis identifies a supplier in the industry as a potential M&A target, there are two resulting actions you can take.

Assuming that a key supplier is likely to be acquired soon, you should be prepared for a shortage in supplies or a much larger and stronger competitor

You could consider acquiring that supplier before anyone else does, in order to be bigger and stronger, in order to secure your own source of supply, or in order to prevent another firm from doing so before you do

2. Are our trade secrets likely to leak and who would they go to?

Many firms take great pains to create policies, educate their employees and insert legal clauses in contracts to protect their internal intelligence. Most telecom innovation companies, for example, treat their switchboard operators as front line 'guards'. Employees are told not to participate in surveys, talk to the media or tell anyone anything. Yet, somehow trade secrets still go public.

Individuals outside any given business conduct some of a company's work. The value chain is hence often bigger than just one firm. In working together with suppliers, information must be shared. But who says that your supplier has the same policies? Or the same code of ethics? What do your suppliers' employees do to protect the innovations of your firm?

In the new global economy, a purchase decision that looks good on paper may include cultures that thrive on reverse-engineering or where information can be bought. Apple recently discovered that the link between its own company and its suppliers was tainted with information that should not have been shared. A senior team member had been supplying intelligence to suppliers to enable them to achieve better contract terms in exchange for kickbacks, all at the expense of Apple's ability to compete. Apple discovered the intelligence leak too late, and now faces court cases, employee discipline activities, renegotiating supplier contracts and private company information that has been made public.

Possible solutions

To ensure that that the immediate value chain is water-tight, counter-intelligence projects can confirm that the policies within your own firm are working, and that as much as other parties may try, your suppliers are loyal and will not reveal intelligence about your products, services, processes and plans. Of course it is always ideal to work with suppliers that match your company's culture. Aside from long term partnerships, company profiling and counter-intelligence are alternative methods of determining what kind of company you are releasing important corporate information to.

Supplier Selection Mapping

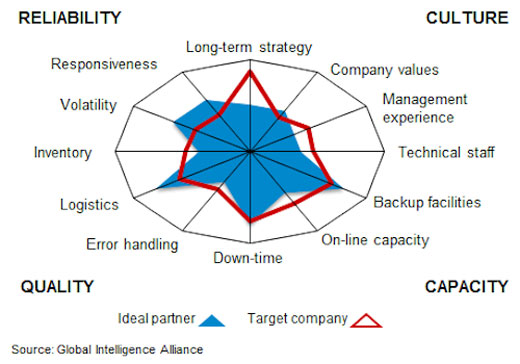

Consider measuring suppliers and potential vendors on multiple scales to ensure that they truly fit the target your company is seeking.

3. Can our suppliers really deliver?

Supply chain managers are responsible for finding and maintaining relationships with partner companies that ultimately enable or deny our firm's ability to succeed. While the rest of the firm is planning strategy, producing sales and churning out products and services, they are all trusting that their strategic sourcing and procurement team is doing their best to engage with reliable supply partners who are dedicated to serving their long term needs.

How do supply chain management professionals do this best? Beyond an RFP, proposal, lunch meeting and a handshake, a little bit of due diligence goes a long way. The international web-based marketplace firm, Alibaba.com Ltd., recently discovered that many of the companies that were using its platform proved to be fraudulent suppliers, as a result of little-to-no due diligence. In a business-to-consumer scenario, a fraudulent supplier is a frustration. In a businessto-business situation, a fraudulent supplier affects a brand's ability to deliver. Alibaba.com could have invested in some due diligence research to avoid losing the faith of so many customers and the employment of two senior executives.

Possible solutions

Due diligence research provides you with important information on a company so you can make an informed decision. A quick company profiling exercise may discourage you from continuing with a merger, joint venture, supply contract or any agreement in principle.

Here, we have provided three basic questions companies should ask about their supply chains. There are many more that are specific to a company's internal needs, industry and geographic spread.

Fortunately, avoiding risks, assisting with revenue generation and making long-term, sustainable and profitable choices have become achievable today with the right market intelligence partners. International and growing businesses must rely on continuous monitoring of their industries, competitors and suppliers, and analyses of counter-intelligence to be informed about the risks, opportunities and blind-spots in and around their supply chains.

Add a Comment

No messages on this article yet