The Challenging Road

Automobiles are held together not only by nuts and bolts but also by a robust supply chain. The fact that the automobile supply chain is a critical component in productive manufacturing is seen in the examples cited above, are not separate one-off incidents. Instead, they represent the Supplier Risk Management (SRM) paradigm. With the supply chain extending across the globe, automotive original equipment manufacturers (OEMs) are increasingly affected by supply chain disruptions such as supplier bankruptcy. Thus, SRM that helps de-risk such problems assumes great importance in ensuring uninterrupted production and increasing profits.

Legacy enterprises, critics and analysts are driving the supply chain procurement and sourcing focus on two broad roads Supplier Performance Management and Supplier Relationship Management. Although these have yielded control mechanisms in the supplier community, the design has intrinsic limitations by way of post-facto analysis as this paper shows. As the automotive market shrinks and the product portfolio becomes short-lived, susceptibility to supply chain disruptions tends to zero. Now, automotive OEMs are scouring for breakthrough solutions to infuse supplier dependency confidence. This paper explains in detail the Collaborative Procurement Platform (CPP), which can help address such OEMs woes.

Existing Limitations OR Uphill Ride

To overcome the, challenge of identifying the right solution to de-risk supplier bankruptcy, healthy Automotive OEMs employ some de facto strategies, such as:

1. Develop an early warning system of supplier financial health: OEMs keep a cautious watch over the suppliers financial health by monitoring metrics like days of receivables, days of inventory stock, debt-equity ratio movement, capital adequacy ratio, and supplier requests for order-pricing and order-credit terms, etc. Here, setbacks arise when most suppliers craftily manage these metrics to postpone disclosure.

2. Know your suppliers supply chain: OEMs observe and monitor the tiers of suppliers in the supply chain. Although this method seems ideal, it is often cumbersome and contentious mainly because most suppliers prefer to manage their own suppliers without external interference. Further, suppliers of proprietary components usually do not reveal their detailed supply chain.

3. Develop alternate suppliers: This strategy is difficult to implement. The gestation time for a new supplier to develop a component is between 6 and18 months depending on the complexity. Besides this, developing close intuitive relations with the supplier takes years. Additionally, certain technology constraints can deter any profitable exit strategy from the supplier.

Given the current situation of 33~35% of all US suppliers at the risk of bankruptcy (independent research done by AT Kearney and Grant Thorton LLP) , these classical measures have limited advantages and yield few results. OEMs must devise newer strategies to address the SRM problem.

Collaborative Procurement Platform The Speed Zone

Radical changes in the procurement strategy can defuse the threat of supplier bankruptcy. A Collaborative Procurement Platform (CPP) among OEMs can create a breakthrough environment where the buyers of multiple automotive OEMs merge to evaluate their aggregate demand for platform components at prices commensurate with the economies of scale of these components. A robust evaluation strategy for such a breakthrough is necessary. An illustration of the evaluation criteria is given below:

Figure 1: CPP Evaluation Criteria

A Roadmap

OEMs can initiate the CPP strategy by adopting the following steps:

Step-1: OEMs scout out for the right partner for a joint CPP strategy. This is a tricky step, as Procurement professionals have to leave aside competitive back-biting to enter into strategic collaboration. Top Management sponsorship from each OEM is necessary. In Japanese Keiretsu-type close knit supplier control environment, this is a major challenge. It is here free markets like US and Europe will lead the way. And the present plummeting demand in market would be the right time for procurement professionals to come together to forge broader tie-ups. Since this is more strategic than operational, it is for the automotive OEMs to devise their strategies. One guideline would be to start with Automotive OEMs who share suppliers who should come together.

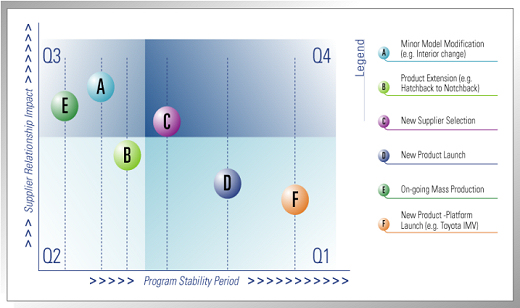

Step-2: OEMs choose the appropriate program with which to implement the CPP strategy. The program is evaluated based on two broad criteria:

Impact of change on the supplier relationship due to the CPP strategy

Lead-time required for achieving a steady-state stability for the programs without the CPP strategy

Figure 2 depicts the various programs for a typical automotive OEM.

Two random scenarios among the six shown in the figure are explained, for the benefit of the readers to appreciate the rigor of the evaluation framework.

Minor Modification (A) : This takes one of the minimal time to stabilize, and creates the highest impact since there is tremendous turbulence among existing suppliers whose parts have not undergone changed.

New Supplier Selection (B): The new supplier requires moderate time to get on board and stabilize, but this has with it tremendous impact on existing suppliers.

In such a scenario, it is recommended that the automotive OEMs begin with programs in Quadrant Q1, followed by programs in Quadrant Q2, and then move onto programs in Quadrant Q4 and end with programs in Quadrant Q3. Such a strategy ensures that the CPP launch undergoes minimal impact and upheaval during the intrinsic lead-time period required for the program to stabilize.

Figure 2: CPP Introduction Strategy in Product Development Programs

Step-3: Each program requires a sensible selection of suppliers. This selection is primarily based on the nature of the supplier/vendor competency and their level of involvement in the program. Table-1 below describes the basic functions of each category of the suppliers/ vendors. Vendors with the lowest involvement level are first franchised into the CPP platform and a roadmap is developed to include all vendors participating in the product development program. Figure 3 presents a brief description of the supplier/vendor categories and their involvement levels.

Fig-3: Supplier Classification and Involvement in Product Development programs

Type of Supplier | Function |

Own Design supplier (OD) | Design proprietary products and tooling. Their involvement is the highest in any program |

Own Tool Vendor (OTV) | Procure product and tool design from OEMs but manufacture their own tools for component development. Their involvement is least in an ongoing mass-production program |

Contract Manufacturers (CM) | Procure product design and tools from automotive OEMs. Their involvement is again lowest in an ongoing mass-production scenario. |

Standard Parts manufacturer (SP) | Manufacture standard components like fasteners, hoses, clips etc. Since their components are commoditized their involvement is low in all programs. |

Table 1: Supplier/ vendor category and their functions

When including suppliers in a CPP strategy, a program ideally begins with SP suppliers who are followed by CM suppliers, then the OTV suppliers and, finally, OD suppliers. This sequence differs slightly in a mass production scenario where CM suppliers are brought in before SP suppliers.

Navigating Potholes

When deploying a CPP strategy, OEMs must be wary of the following mistakes:

Do not treat all programs alike

The stability period is generally taken as the average period between product launches

All factors of supplier relationship impact are not taken into consideration for arriving at the weighted score

No incentives are given to suppliers who enlist for a platform

It is imperative that Automotive OEMs avoid the above errors to ensure a smooth and profitable journey for their CPP strategy. The possible Daimler-BMW or Continental AG and Schaeffler Group partnership mandates testing the stringent evaluation and structured process if it is to bring positive results that enhance the bottom line.

Sudripto De, CSCP, CPF

Principal, Consulting Services, Manufacturing and Supply Chain Practice

Infosys Technologies Limited

About the Author

Sudripto is a Principal in Consulting Services in the Manufacturing and Supply Chain practice. He leads multiple management consulting projects with global Fortune 500 firms in Supply chain risk management, strategic sourcing, distribution planning & optimization and core manufacturing excellence. He has 16 years of experience in the industry and business consulting, and has developed IP and patents in advanced supply chain analytics.

Sudripto shares his thought leadership on SCM at Infosys Supply Chain management blog: www.infosysblogs.com/supply-chain/

He can be reached at: Sudripto_De@infosys.com

Add a Comment

No messages on this article yet