Lack of management buy-in, inadequate systems and insufficient resources are just some of the barriers to reverse logistics that have plagued companies for years. But market needs are changing-customers are becoming more demanding, product life cycles are shortening and regulations are emerging-forcing businesses to become more aware of the need for a robust reverse logistics management system.

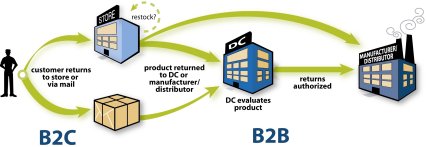

Research and analysis company, Gartner, has estimated that improperly handled returns can erode 30 to 35 per cent of potential profits. In order to salvage these profits, companies must make changes to their B2C and B2B returns processes.

Recovering assets one customers at a time

Reverse logistics starts with making the returns process easy for them, while imposing sound and fair return policies.

B2C companies may choose to accept returns via Web site, phone and/or in-store. Products can either be taken back as is or may require a return merchandise authorisation (RMA) number. This permits the return of the product by providing an inbound tracking number to assist in the receiving process. Businesses also have the option of including a return label with an RMA in the original packaging.

Before a B2C return is accepted, a verification process must take place to ensure that all returns are valid to be taken back, for example they fall within a 30-day returns policy.

RMAs can further expedite this process by providing real-time historical information on items. The return history provided by RMAs helps reduce fraudulent returns, minimise human error, cut costs and improve customer satisfaction levels. According to Gartner, in online sales alone, automating the front end of returns offers an opportunity to reduce costs by as much as 73 per cent.

End-to-end visibility and control of the returns process is necessary to maintain constant communication flow and achieve the highest level of net asset recovery. Net asset recovery is defined as the value for which a returned product is sold minus all costs incurred to make the sale. This includes labour and refurbishment.

A successful reverse logistics programme goes beyond simply being able to process returns. Half of all returned goods take between one and two weeks to be processed; another 25 per cent sit for more than a month. Turnaround time can mean the difference between profit and loss, especially with time-sensitive items. For instance, holiday and seasonal merchandise can only be sold for a brief period of time. In order to expedite the return process and recover funds, companies must have insight into this returned inventory and the ability to execute against the actions that will yield the highest asset recovery.

Businesses thinking ahead

B2B returns may also be necessary for a variety of reasons: if goods are damaged, defective, or under warranty, manufacturers and distributors are obligated to take them back. However, B2B returns may include overstocked goods and vendor buy-backs. For example, a company may purchase a certain number of a particular item based on past sales, but be unable to reach that same sales level again. Instead of losing money by having the goods sit on shelves, these companies want to return them for a refund or for credit towards future purchases. This is where the B2B returns process can become more complex.

Distributors and manufacturers typically form agreements with their channel partners to outline the quantity of acceptable returns as part of contract negotiations. This can be impacted by the volume of business transactions between the two companies, past number of returns and/or the type of goods. Once set, only returns falling within the established parameters are authorised to be accepted.

Distributors and manufacturers historically did not have the visibility to track this information and ensure that customers were in compliance. Returns were handled by specialised personnel leaving no centralised resource for information gathering. As a result, distributors and manufacturers would accept returned goods without verification in order to maintain customer service levels. Fortunately, technology has evolved to the point where companies can combat this issue. Policy engines in reverse logistic software can establish and execute against an accurate, real-time tracking system to ensure that only authorised merchandise is returned.

Rules-based reverse logistics programmes are further enhanced by synchronised communication between trading partners. With visibility into goods in transit and the ability to receive against return advance ship notices (ASNs), both manufacturers and distributors achieve maximum asset recovery. For instance, if a distributor knows that it is receiving 20 televisions from one channel, and two other channels are in need of that same model, it can either automatically cross dock and ship the television sets as they are received, or potentially even re-route them in transit.

Turnaround time is extremely important to a successful B2B returns process. For example, PCs lose approximately 5 per cent of their value for every week they are not sold. Trading partner visibility gives the manufacturer insight into this and enables it to make adjustments and minimise financial losses for both parties.

Future trends in reverse logistics

Awareness of emerging trends along with the ability to adapt to constant change is imperative to success.

More and more companies with B2C returns are looking to online auctions as a popular way to recover funds from returned goods. Another trend in the B2C returns market is customer drive programmes. These are programmes that provide incentives for customers to return reuseablesfrom containers to partsthat can then be recycled or refurbished.

Radio frequency identification (RFID) is an emerging trend impacting all aspects of logistics. By uniquely identifying objects using radio frequency waves to transmit data, RFID tags can fundamentally change the way B2B returns are processed. Tags enable electronic tracking of products at the item, case or pallet level, reducing labour costs, increasing efficiencies and speeding time to market in the distribution process. They can expedite the returns process by providing real-time historical records of returned goods. This can include information from product origin and reason for return, to disposition and store code, all of which help in automating the verification and receipt processes.

Compliance standards present major hurdles. The European Parliament and the Council of the European Union have recently issued a directive that will help reduce the amount of waste sent to landfills. The Waste Electrical and Electronic Equipment (WEEE) and the Restriction of Hazardous Substances (ROHS) regulations are expected to be implemented in EU member states in 2004.

In compliance with these regulations, EU member states will be required to collect 4 kg of categorised waste per person, per year. Achieving this will require manufacturers to accurately track products in order to ensure each member state meets its share. With a system in place that can track returns and provide visibility into product and packaging dispositions, adherence to such standards will be much easier.

Footnotes

Bob Trevilock, Logistics Management and Distribution Report, June 2002

David Hommrich is the Senior Director of Reverse Logistics Management for Manhattan Associates. He has been in the software business for over a decade, with two successful start-ups to his credit. His most recent company (ReturnCentral, Inc.), was acquired by Manhattan Associates in June, 2003. He runs the Reverse Logistics Management (RLM) organisation at Manhattan Associates and is responsible for setting the company direction in this important segment of the overall supply chain. He has a BS in Chemical Engineering.

Add a Comment

No messages on this article yet