The ongoing downturn of the UK manufacturing sector continued in August.

The ongoing downturn of the UK manufacturing sector continued in August.

At 45.9, up only slightly from Julys nine-and-a-half year low of 44.1, the seasonally adjusted CIPS/Markit Purchasing Managers Index (PMI) remained at a level consistent with a marked deterioration in overall operating conditions.

A weak domestic market and elevated inflationary pressure weighed on order books in August, leading to a sharp retrenchment in new work received and lower levels of production. However, the rate of decline in output was noticeably slower than one month ago, as a number of firms diverted spare capacity towards completing existing contracts. Backlogs of work declined at the fastest rate in the series history.

August data indicated that the downturn remained broad-based by sector. New orders declined across the consumer, intermediate and investment goods sectors. Output also fell at producers of consumer and intermediate goods. In contrast, the capital goods sector bucked the trend of lower output, to record an increase for the first time in five months.

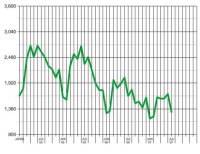

On the prices front, August saw output charge inflation hit a further series record high as the seasonally adjusted Output Prices Index posted a reading of 64.5. The recent trend in the index suggests that there has been a noticeable increase in cost inflationary pressure during mid-2008, with three out of four highest ever readings posted during the past three months.

The rate of increase in average input costs eased slightly from the previous months peak, but remained well above its long-run average. Companies attributed rising purchase prices to the high cost of energy, food products, fuel, metals and oil. However, there were some reports that recent declines in the cost of certain commodities including oil and metals were starting to filter through to manufacturers.

Conditions in the labour market remained weak in August, with job cuts reported for the fifth successive month. The seasonally adjusted Employment Index came in at 43.8, which though slightly higher than the previous month, was still the second-lowest reading since late 2001. Reports of job cuts were widespread in August, with almost one-in-five companies seeing employment drop and declines recorded in the consumer, intermediate and investments goods sectors.

August data indicated that the ensuing downturn of the global economy reduced the level of new export orders placed with UK manufacturers. The New Export Orders Index posted a reading of 46.4 little changed from Julys six-and-a-half year low of 46.3. Companies reported lower levels of new business from clients based in mainland Europe and the US.

Purchasing activity declined to the greatest extent in over nine-and-a-half years in August as elevated cost inflation led a number of firms to reduce non-essential expenditure. Stocks of purchases and finished goods both fell in the latest survey period as the seasonally adjusted Stocks of Purchases Index came in with a reading of 43.5.

Comments:

Roy Ayliffe, Director of Professional Practice at the Chartered Institute of Purchasing and Supply, said:

Although the manufacturing economy improved marginally from Julys nine-and-a-half year low the sector is still declining but at a slower rate. Purchasing managers reported that the weak domestic market and inflationary rises added further pressures. In particular, costs continued to surge on the back of high energy, food and fuel prices while the weak sterling also pushed up the cost of imports.

Purchasing managers cited that volumes of new orders and levels of output suffered, while jobs were axed for the fifth month in a row.

Rob Dobson, Senior Economist at Markit Economics, said:

The downturn in manufacturing continued into August, as a lacklustre domestic market and high inflationary pressures eroded confidence at businesses and households alike. These factors weighed heavily on order books, while the ensuing global economic slowdown meant there was no support from the external sector. The rate of contraction in output eased noticeably but, being driven by an upshot in the capital goods sector where new order volumes are especially depressed, this probably reflects the excessive weakness of the previous month as opposed to any near-term improvement in performance. The stagflationary binds that are tying the MPCs hands are still in place, making an imminent rate movement unlikely, but the ensuing economic slowdown and recent commodity price decreases should open the door to a cut later in 2008.

The September Report on Manufacturing will be published on Wednesday 1 October 2008

Notes:

The CIPS/Markit UK Manufacturing PMI is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 600 industrial companies. The panel is stratified geographically and by Standard Industrial Classification (SIC) group, based on the regional, and industry contribution to GDP.

Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the Report' shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the diffusion' index. This index is the sum of the positive responses plus a half of those responding the same'.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The CIPS/Markit UK Manufacturing Purchasing Managers' Index (PMI) is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers' Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times Index inverted so that it moves in a comparable direction.

The Purchasing Managers Index (PMI) survey methodology has developed an outstanding reputation for providing the most up-to-date possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices. The indices are widely used by businesses, governments and economic analysts in financial institutions to help better understand business conditions and guide corporate and investment strategy. In particular, central banks in many countries (including the European Central Bank) use the data to help make interest rate decisions. PMI surveys are the first indicators of economic conditions published each month and are therefore available well ahead of comparable data produced by government bodies.

Where appropriate, please refer to the survey as the CIPS / Markit UK Manufacturing PMI.

About CIPS

The Chartered Institute of Purchasing & Supply (CIPS) is the leading international body representing purchasing and supply management professionals. It is the world-wide centre of excellence on purchasing and supply management issues. CIPS has over 44,000 members in 120 different countries, including senior business people, high-ranking civil servants and leading academics. The activities of purchasing and supply chain professionals can have a major impact on the profitability and efficiency of all types of organisation.

About Markit

Markit is a financial information services company with more than 700 employees in Europe, North America and Asia. Over 1,000 financial institutions use our independent services to manage risk, improve operational efficiency and meet regulatory requirements

About Markit Economics

Markit Economics is a specialist compiler of business surveys and economic indices, including the Purchasing Managers' Index (PMI) series, which is now available for 26 countries and key regions including the Eurozone and BRIC. The PMIs have become the most closely watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends.

The intellectual property rights to the UK Manufacturing PMI provided herein is owned by Markit Group Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markits prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (data) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Markit, PMI and Purchasing Managers' Index are all trademarks owned by The Markit Group.

Add a Comment

No messages on this article yet